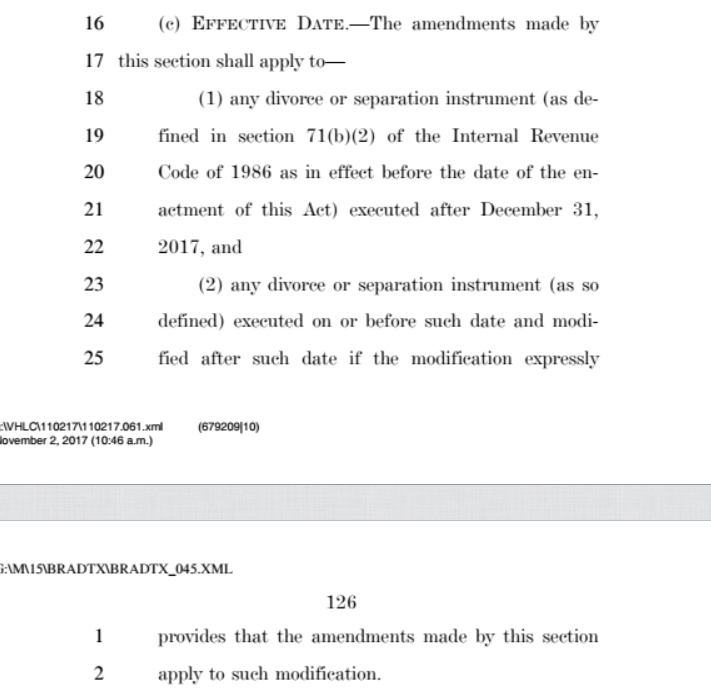

Frank is correct. If passed, the new provision would apply to decrees or agreements entered after December 31, 2017, or any modifications of earlier agreements/decrees where it expressly indicates that the new tax law making it non-taxable and non-tax deductible is to apply.

Here is the language from the proposed Act:

------------------------------

Brian G. Paul, Esq.

Certified Matrimonial Law Attorney

Szaferman, Lakind, Blumstein & Blader, P.C.

101 Grovers Mill Road

Lawrenceville, New Jersey 08648

Phone: 609-275-0400

Direct Fax: 609-779-6065

[email protected]------------------------------

Original Message:

Sent: 11-03-2017 07:43

From: Geraldene Duswalt

Subject: The GOP tax plan and how it would impact alimony

I read this morning that one of the deductions that they are planning to eliminate is the alimony deduction. Did anyone else see that? Would that mean that alimony is no longer tax deductible to the payor, but would it still be taxable to the payee? That would not make sense but if its treated like child support and not taxable or tax deductible then where does that leave people that settled their cases based upon the premise that they can deduct alimony? Or maybe I just read that wrong, anyone else?

I know its a long way from passing and a lot can change but that just stuck out in the article.

Gerri Duswalt

GERALDENE SHERR DUSWALT, ESQ.

ATTORNEY AT LAW

Admitted in New York and New Jersey

1812 Front Street

Scotch Plains, N.J. 07076

576 Fifth Avenue, Suite 903

New York, N.Y. 10036

Telephone: (908) 322-5160

Fax: (908) 654-3970

General practice of law serving the legal needs of the community, family and matrimonial law, bankruptcy, real estate, wills and general litigation.

This e-mail and any documents accompanying this e-mail may contain information from the law office of Geraldene Sherr Duswalt, Esq. that is intended to be for the use of the individual or entity named in this e-mail transaction and which may be confidential, privileged or attorney work product. If you are not the intended recipient be aware that any disclosure, copying, distribution, or use of the contents of this e-mail is strictly prohibited. If you receive this e-mail in error, please notify the sender at once.